MISUMI’s Digital MODEL Shift continues to advance as planned, with Fictiv Inc.—a U.S. company consolidated since July—also demonstrating strong performance. As a result, the full-year earnings forecast has been revised upward

MISUMI’s Digital MODEL Shift continues to advance as planned, with Fictiv Inc.—a U.S. company consolidated since July—also demonstrating strong performance. As a result, the full-year earnings forecast has been revised upward

For the first half of the fiscal year, the global economy continued to face uncertainty due to factors such as U.S. tariff policies, their impact on various countries, and unstable exchange rates. As a result, there was a slowdown in operations in major customer industries, particularly the automotive sector. However, demand in telecommunications, electronics, and electrical equipment sectors remained steady, especially in China and Asia.

In this economic environment, MISUMI Group is leveraging its unique Business MODEL, which encompasses manufacturing and distribution businesses. By advancing the global Business foundation supporting these operations, we contribute to industries related to automation demand, particularly the manufacturing industry, by meeting customers' needs for Reliable and Quick Delivery. We continued to develop new businesses, including new products and services, by capitalizing on the robust business foundations in IT, production, and logistics that we have built over the years. We also made efforts to accurately capture customer demand by making use of our global network of sites. However, in certain regions, U.S. tariff policies caused demand to remain stagnant.

As a result, consolidated net sales reached a record high for the first half totaling ¥205,814 million (3.9% increase year-over-year). By segment, in the FA business, while capital investment demand in Japan remained sluggish, overseas regions generally performed well. This growth was driven by proprietary initiatives such as capturing demand in China’s telecommunications sector, as well as through meviy, the Economy Series, and D-JIT. Additionally, with Fictiv Inc.’s performance included in the consolidation from July, sales reached ¥72,743 million (8.8% increase year-over-year). In the Die components business, growth in China and Asia helped offset weaker performance in other regions caused by sluggish demand in the automotive sector. However, sales did not attain the level recorded during the same period in the previous year, totaling ¥42,573 million (0.6% decrease year-over-year). In the VONA business, performance remained strong, especially in China and Asia, with sales reaching ¥90,498 million (an increase of 2.4% year-over-year).

In terms of profits, although there were positive effects such as increased volume from proprietary initiatives, ongoing expenditures related to measures geared for sustainable growth, the impact of exchange rates, and the inclusion of Fictiv Inc.’s performance within the scope of consolidation starting in July led to operating income of ¥19,618 million (16.1% decrease year-over-year), ordinary income of ¥20,397 million (19.1% decrease year-over-year), and interim net income attributable to parent company shareholders totaling ¥13,997 million (23.1% decrease year-over-year).

Full-scale launch in Japan of the fourth Digital MODEL “MISUMI floow”

Full-scale launch in Japan of the fourth Digital MODEL “MISUMI floow”

With respect to the full-year consolidated earnings forecast, the automotive sector continued to face challenges during the first half of the fiscal year, primarily due to the impact of U.S. tariffs, resulting in ongoing uncertainty in both Japan and Europe. Nonetheless, proprietary measures - including the integration of Fictiv Inc., whose results have been included since July - proceeded as planned. Reflecting this progress, recent foreign exchange developments, and the strong performance of Fictiv Inc., we have raised our consolidated earnings forecast. Net sales are now expected to reach an all-time high, as disclosed on October 31, 2025.

Our key initiatives moving forward will include continuing efforts to address the diversifying needs of automation customers through the development of Digital MODELs, as well as establishing a unique competitive advantage through synergies with region-specific growth strategies.

Our online machinery parts procurement service “meviy,” launched as the first installment of our Digital MODEL Shift, is stepping up its penetration into both Japanese and overseas markets. The service has attracted over 210,000 users globally on a cumulative basis. Fictiv Inc., which provides on-demand custom mechanical components procurement service in the U.S. and was included in the scope of consolidation in July, is also performing solidly. Moving forward, we plan to generate synergies between Fictiv Inc. and MISUMI, including more streamlined operations, cross-selling, and business expansion position us for continued growth.

The highly price-competitive “Economy Series,” launched as the second installment of our Digital MODEL Shift, continues to enjoy rapid growth, primarily in the price-sensitive markets of China and Asia. We will continue to strengthen initiatives tailored to each region, such as developing new catalogs, localized procurement, and marketing, to further accelerate growth.

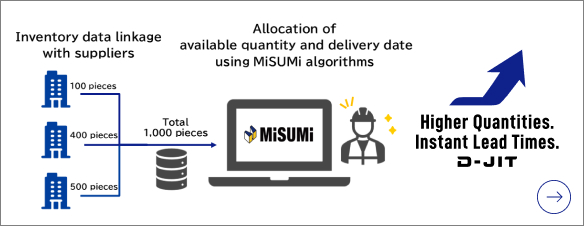

The third installment, “D-JIT,” which accommodates customer requests for large quantities with quick delivery, has demonstrated significant growth. Overseas net sales in the first half increased by 130% year-over- year, attributable to enhanced overseas expansion efforts. In the second half, we intend to implement core systems in the U.S., Mexico, and India, further broadening the geographic reach of D-JIT’s utilization.

Following these initiatives, the fourth installment, which officially launched in Japan this fiscal year, is the “MISUMI floow” indirect materials total cost reduction service. As of the first half, the rollout has expanded to 480 factories in China, where it was launched earlier, and 110 factories in Japan. Looking ahead, we plan to further strengthen our position in the Chinese and Japanese markets while steadily increasing our footprint throughout Asia.

In this business, we have not only maintained strong relationships within our established customer bases, such as the automotive and electronics sectors, but have also successfully extended our reach into emerging industries including food, pharmaceuticals, and furniture. Moving forward, we will continue to refine the functionality of the MISUMI floow system, actively pursuing opportunities to generate demand in additional markets.

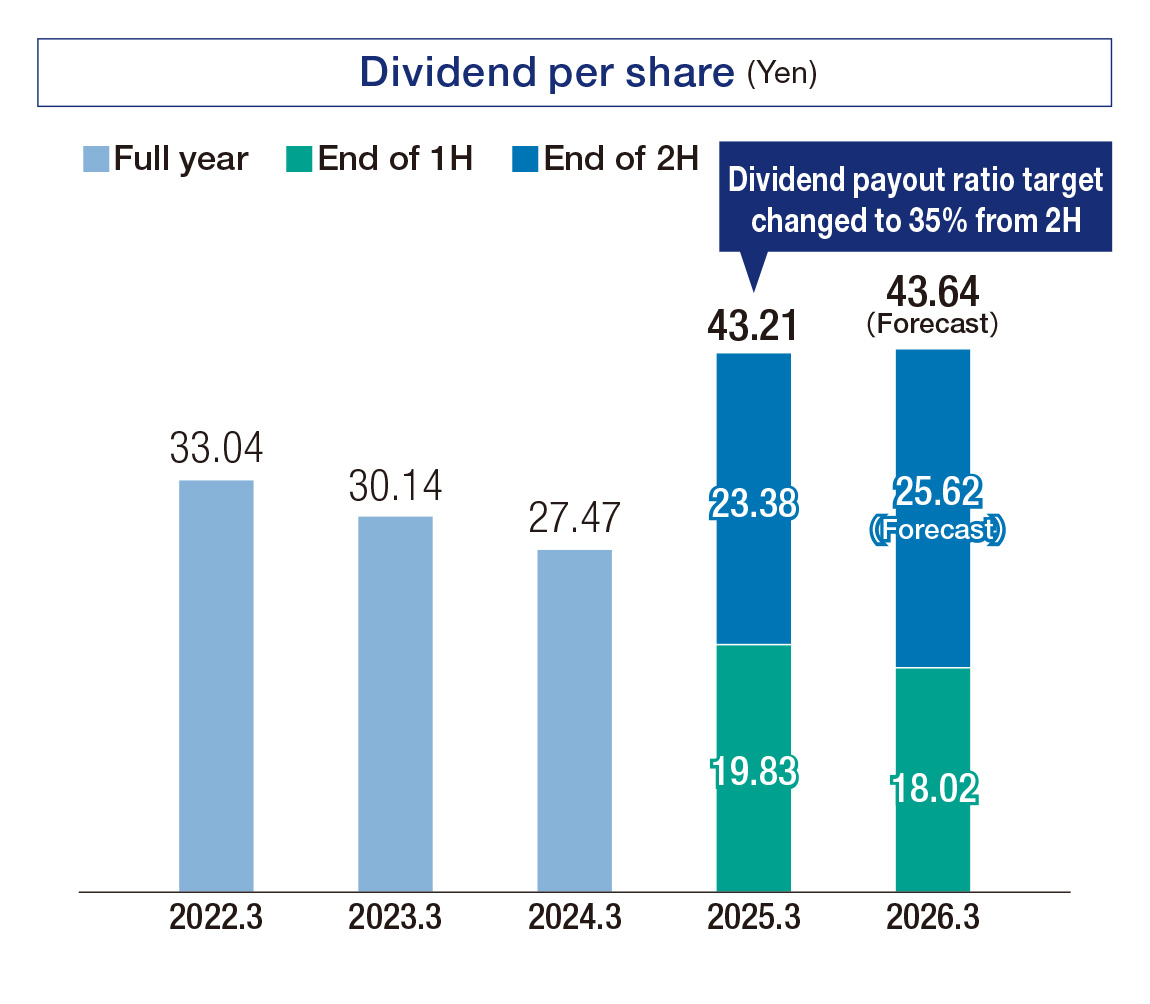

Raising the annual dividend forecast to ¥43.64 per share

Raising the annual dividend forecast to ¥43.64 per share

The Company seeks to balance medium- to long-term growth investments with returning profits to shareholders. In determining the dividend, we consider factors such as expanding our management base, strengthening our financial position, and improving capital efficiency, based on our benchmark payout ratio of 35%, which we established beginning with the year-end dividend for the fiscal year ended March 31, 2025. As a result, for the fiscal year ending March 31, 2026, we have determined an interim dividend of ¥18.02 per share (¥1.81 decrease year-over-year), while the year-end dividend forecast has been revised to ¥25.62 per share (¥2.24 increase year-over-year) due to the revision of the consolidated earnings forecast. The annual dividend is expected to be ¥43.64 per share.

Kosuke Nishimoto

Representative Director and Chairman

Ryusei Ono

Representative Director and President

MISUMI's e-Commerce Site

We supply custom parts for automation devices and equipment, dies/molds, tools, consumables, and more, with same-day shipping at the earliest. Products from more than 3,000 domestic and international third-party brands, including MISUMI, are offered.